AVS

Old Age and Survivors' Insurance

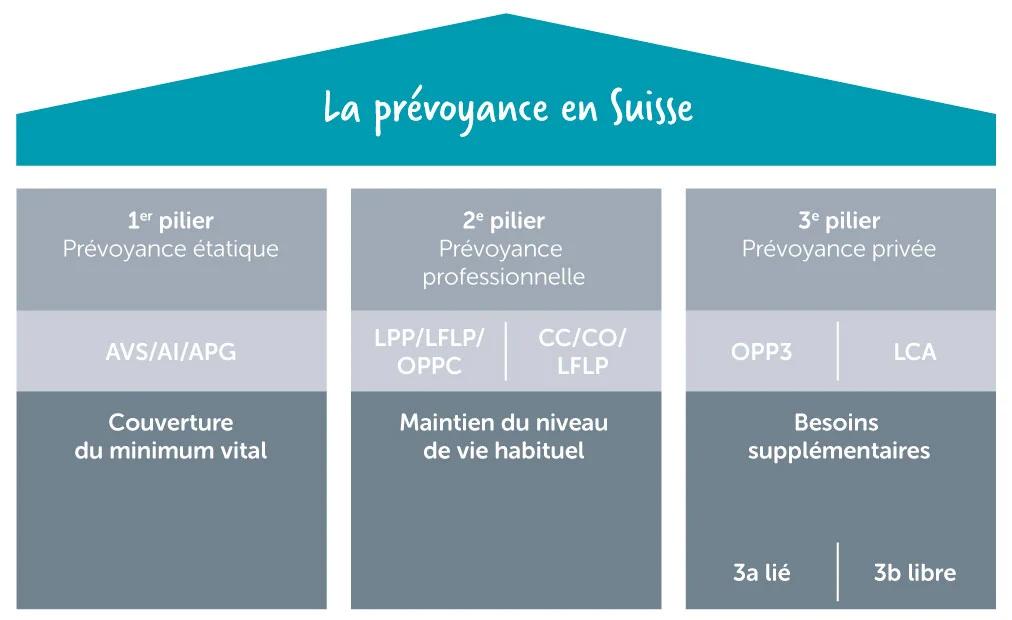

The state pension scheme is compulsory and provides the legal minimum for the entire Swiss population. It comprises 3 insurance schemes, namely the:

Old Age and Survivors' Insurance

Invalidity insurance and supplementary benefits

Allowance for loss of earnings

The AVS insurance is the one that replaces part of your salary when you reach retirement age; it pays old-age pensions, survivors' pensions, and allowances.

In principle, the obligation to pay contributions applies to all persons living and working in Switzerland who are over the age of 20.

However, there are special cases in which contributions are not due: for example, if the salary does not exceed CHF 2,500 per year; or in the case of a married couple, where one of the two people does not work: if the person who works contributes a minimum of CHF 1,060 per year, the person who does not work does not have to pay any contributions!

To find out about special cases, visit the AVS website.

Anyone who has paid AVS contributions for at least one year is entitled to this pension.

Anyone who has made continuous contributions from the age of 20 until retirement, but for at least 44 years, and who has earned an average annual income of at least CHF 90,720, is entitled to a full pension.

If the duration criterion is not met, payments will be calculated proportionally to the years worked in Switzerland.

If the minimum salary criterion is not met, you will receive an incomplete pension, even if the duration criterion is met.

The APG insurance supplements the AVS or AI insurance if the minimum subsistence level is not covered.

The occupational pension provision is compulsory for all persons employed by a company in Switzerland, earning a minimum salary of CHF 22,680 per year, and from 17 years of age.

Contributions are made by the employer and employee on an equal basis (minimum). The employee's contribution is deducted directly from their salary, while the employer's contribution is paid entirely by the employer. So, in addition to your salary, your employer contributes to your retirement savings capital. Some companies contribute more than the employee contribution. You can discuss this with your employer.

The 2nd pillar insurance supplements AVS insurance and ensures that you build up capital when you retire, enabling you to maintain your previous standard of living. On retirement, the 2nd pillar capital can be drawn either as a pension or as a lump sum, depending on the employee's choice. The pension fund regulations should be consulted for details on all the options available.

Under the Swiss Federal Law on Occupational Retirement, Survivors' and Disability Pension Plans (LPP/BVG), the maximum insured salary is CHF 90,720, including in the event of disability or death; this amount corresponds to the average salary in Switzerland.

People with higher incomes or who are self-employed should consider alternative options to ensure a sufficient additional income.

Private pension provision is optional, but is enshrined in the Federal Constitution and forms the 3rd pillar of the pension system. It is the reason why the government encourages it through tax deductions.

Under the 3rd pillar, each person chooses their own funding system and saves for their own retirement, unlike the pay-as-you-go system under the 1st pillar. The amounts can be paid into a bank account or life insurance policy.

The 3rd pillar should enable you to maintain your usual standard of living when you retire, given that the 1st and 2nd pillars cover around 60% of your final salary.

And given that the maximum salary covered at 100% by the 1st and 2nd pillars is CHF 90,720 a year, the shortfall is even greater for higher annual salaries.

The links contained in this article lead to third-party websites. They are provided for information purposes only and are not intended to lead to the purchase of products offered by Crédit Agricole, which has no commercial ties whatsoever with the owners of the sites in question. This information should not be construed as financial, tax, or other advice.