All you need to know about buying an apartment or house

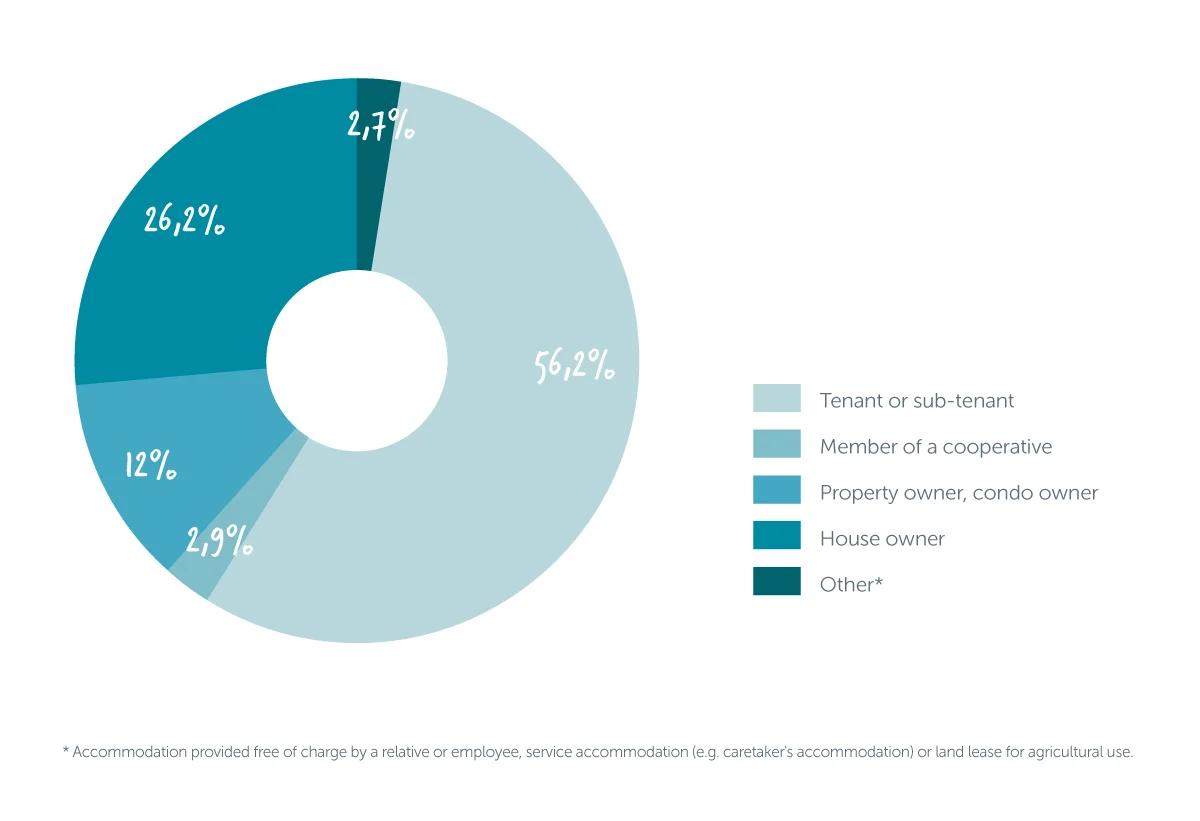

Remain a tenant or become a homeowner? In Switzerland, conditions for buying property are more complex than in other countries. Moreover, 60% of the population rent their home1.

How much does it cost to buy property? How does a mortgage work and what will the impact on your budget be?

Purchase price per sq.m

Do you know how much it costs to buy a four-room apartment in Geneva or a house in Morges?

This data is useful for giving you an idea of the market, checking your borrowing capacity, and above all estimating the amount of equity capital required.

Equity and borrowing capacity

Equity

Equity is a key factor. If you wish to become the owner of your main Swiss residence, you must contribute at least 20% of the purchase price (also called "personal contribution" in other countries). Without this, it is impossible to buy an apartment or house, even if your income allows it. This is a rule applied by all banks and in all cantons.

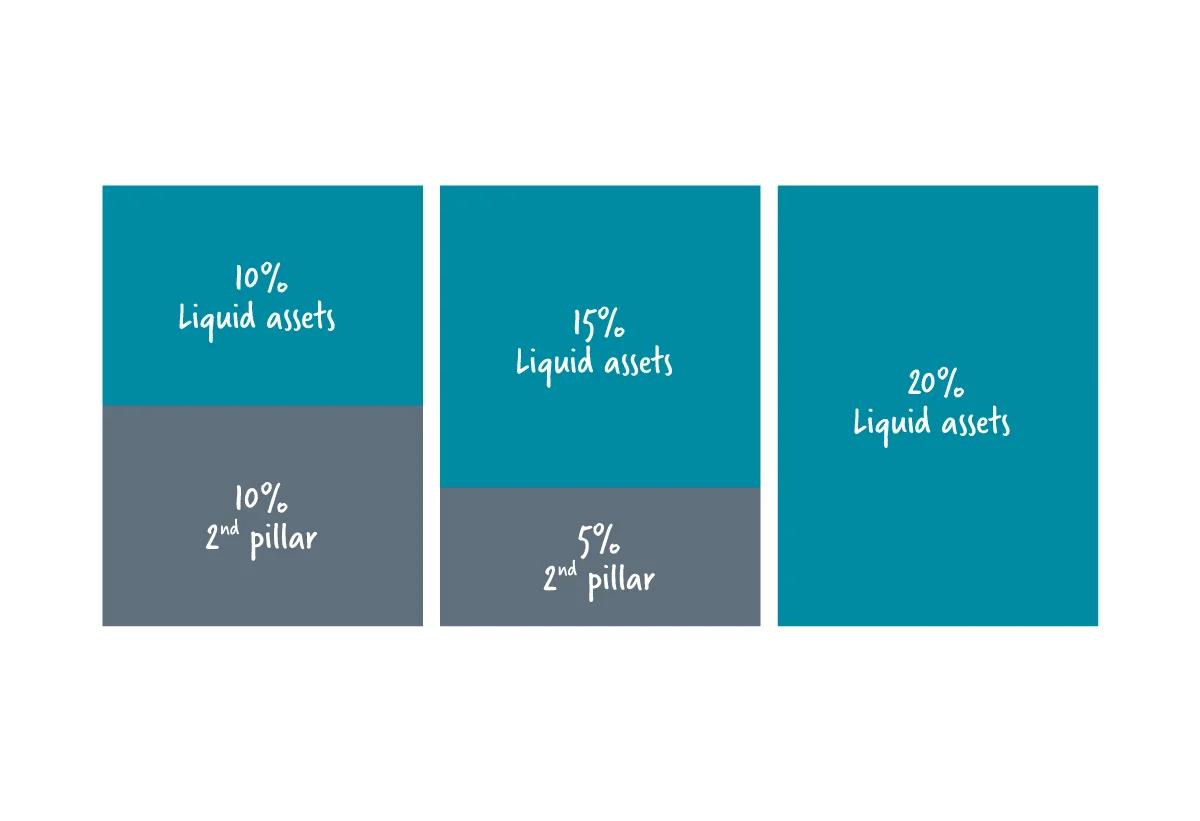

An additional constraint is added: At least 10% of these funds must derive from cash sources, i.e. savings, third pillar, life insurance, gifts, etc. The remaining 10% can come either from cash sources or your second pillar (also called "LPP").

Example of three options:

Example of an apartment for sale at a price of CHF 1,000,000 :

- The bank will lend you a maximum of 80% = CHF 800,000 (mortgage loan)

- You must contribute at least 20% = CHF 200,000 (equity)

Notary fees

In addition to the 20% of equity, you will also need to include the costs of the purchase deed and schedule (e.g. what is known as "notary fees" in France) in your budget. Fees vary depending on the notary and the canton. Notary fees cannot be financed by the bank or by using your second pillar. They must be paid in cash.

Example for information purposes: For a property in Geneva with a purchase price of CHF 1,000,000, these costs would amount to approximately CHF 56,000.

Special feature in the canton of Geneva: You have the option of reducing these costs thanks to the CASATAX provision which aims to encourage access to home ownership. If the purchase price of your property is less than or equal to CHF 1,172,986 (for the period from 1 March 2018 to 1 March 2019), you will then benefit from a reduction of CHF 17,595. In our example, the notary fees would be CHF 38,405 instead of CHF 56,000.

Income and borrowing capacity

In addition to equity, you should also check your borrowing capacity. The aim is to determine the maximum amount you can borrow so that your income will allow you to cover the mortgage in the future. This step will also allow you to narrow down your search by targeting properties within your budget.

At most banks in Switzerland, acquisition-related expenses (mortgage amortisation, maintenance costs, etc.) may not exceed 33% of your gross annual income.

For example, for a property with a purchase price of CHF 1,000,000, your income must be at least CHF 180,000.

If you have other expenses, such as long-term car rental, you also have to take them into account in your calculation.

How does a mortgage work?

You have found the property of your dreams, you have the equity, and your borrowing capacity complies with the one-third rule. Now you need to find a bank that will lend you the money.

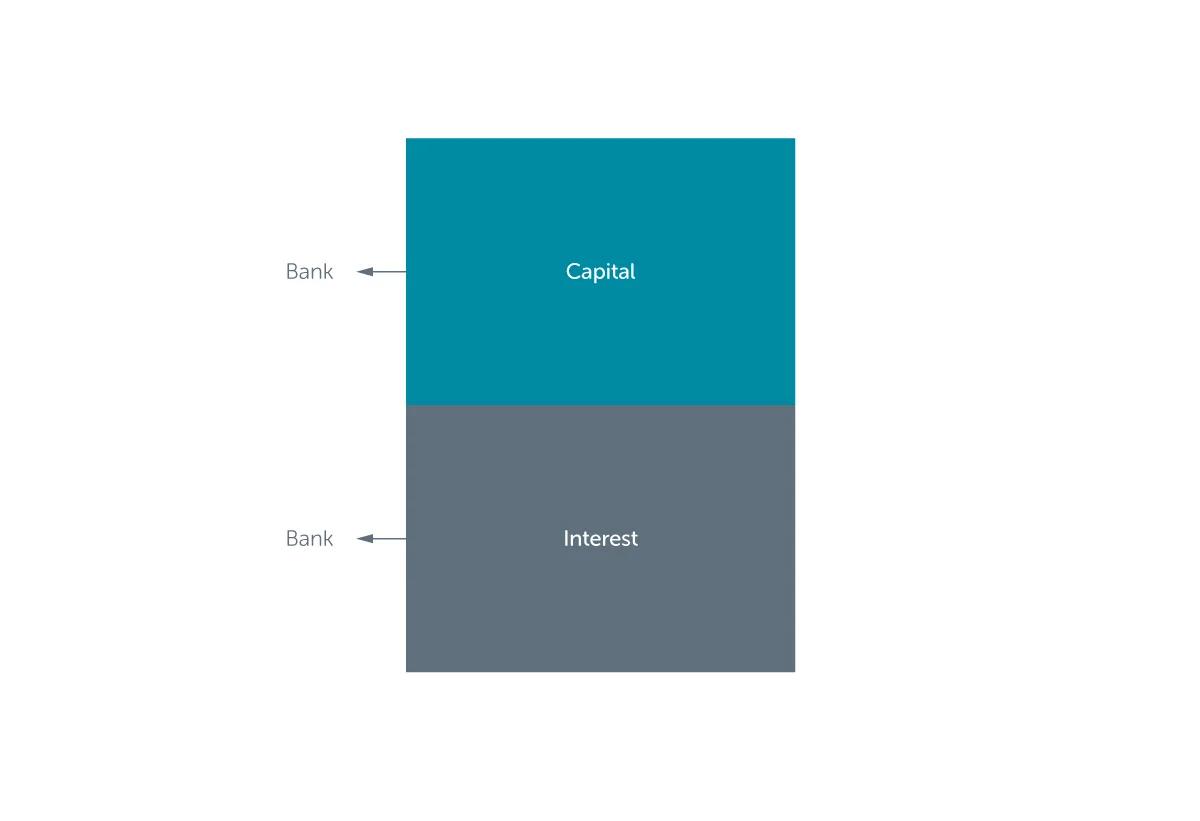

As indicated above, the bank will lend you a maximum of 80% of the purchase price. This sum is then divided into two parts called ranks. In some countries like France or Spain you repay the entire loan over a fixed period. In Switzerland, part of the mortgage loan (first rank) is non-depreciable, i.e. you only repay the interest. By not repaying the principal part of the loan, you are in debt to your bank.

This may seem different from what you know, but this model also allows you to benefit from a reduction in your tax bill since the interest is deductible. The other part (second rank) is depreciable, you repay the interest and principal.

- First rank : Non-depreciable: 66.67% of the purchase price

- Second rank : Depreciable: 13.33% of the purchase price

Second rank direct or indirect repayment

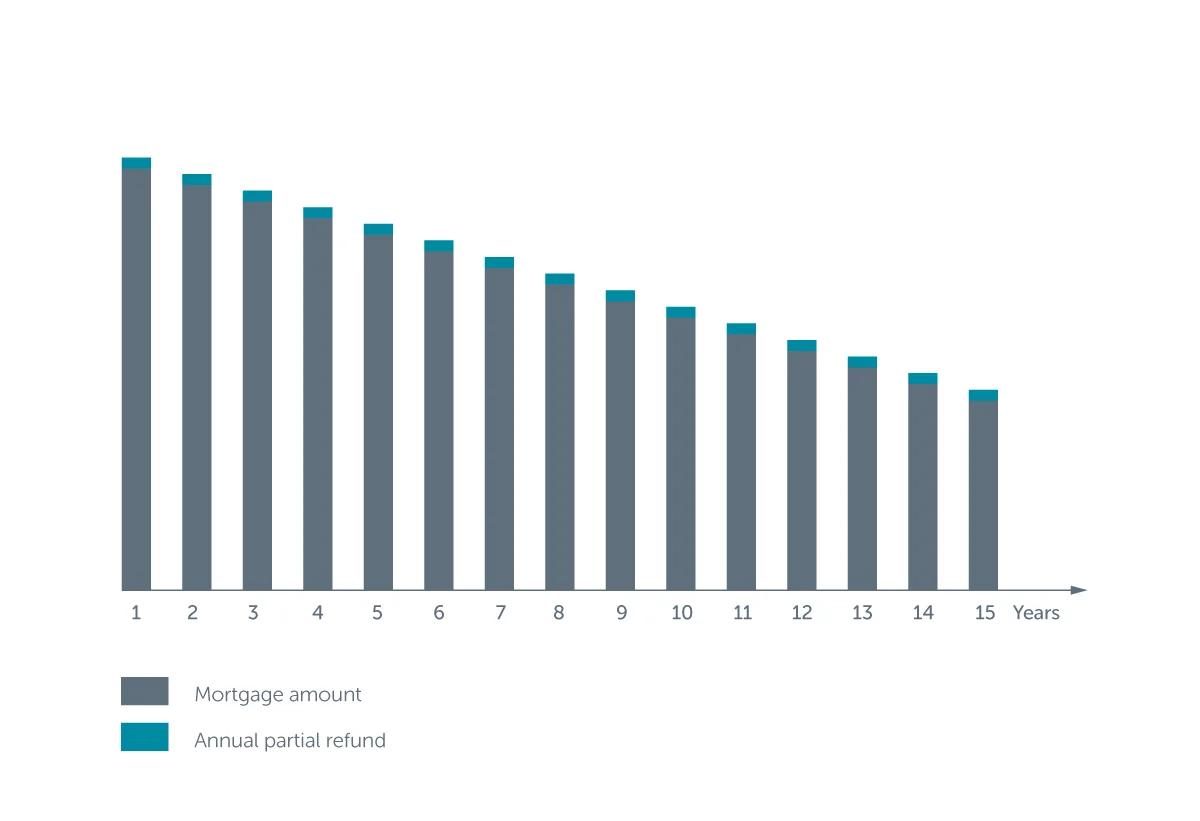

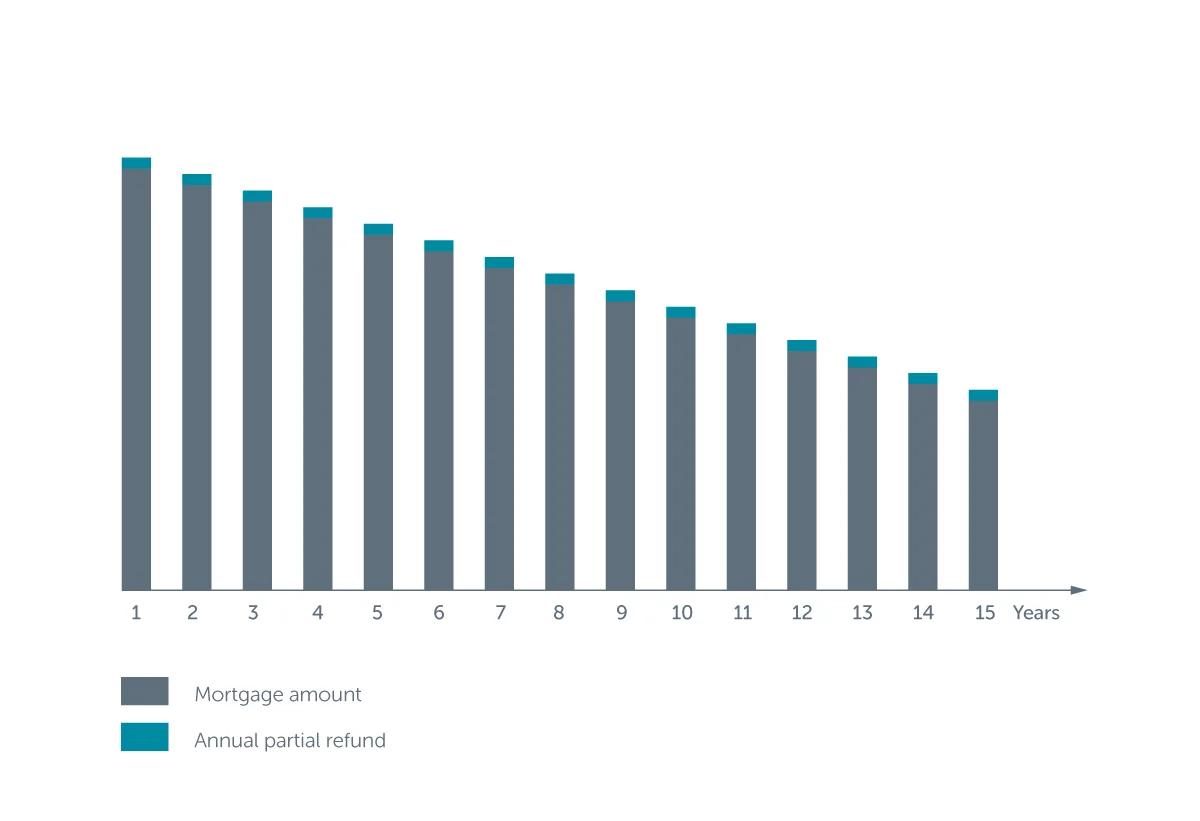

The second rank must be repaid (depreciable) after a maximum of 15 years and within the retirement age limit. There are two options available:

Direct amortisation

How it works

You repay the interest and principal directly to the lending bank on a monthly basis.

Your interest decreases gradually

Indirect amortisation

How it works

You repay the interest to the lending bank on a monthly basis.

The monthly repayment of the capital borrowed is deposited into a third pillar account which will be paid back to the bank (after 15 years) to repay the second rank mortgage.

This model has two tax advantages:

- First, since the debt is not amortised for 15 years, your interest will be fixed and the tax deduction will be higher than with a direct refund.

- Second, payments into a third pillar are also tax-deductible.

The impact on your budget

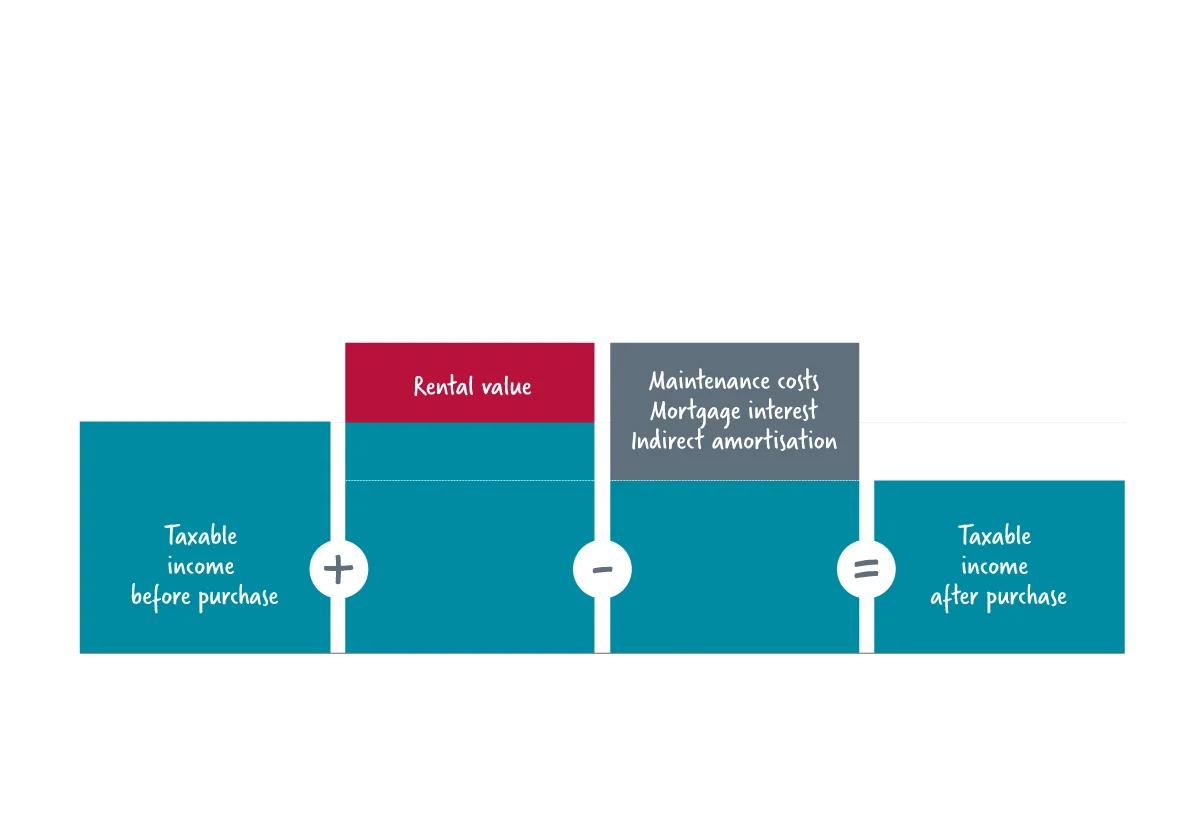

Becoming a property owner will have an impact on your budget, but also on your taxes. There will be new expenses, such as maintenance costs or the value of the lease. On the other hand, it will also be an opportunity to deduct some of them when you file your tax return.

- Your monthly mortgage payment will probably be less than your current rent

- But there will be new costs such as maintenance costs

- A charge called "rental value" will be added to your income on your tax return

- Maintenance costs and the monthly mortgage payment are tax deductible

Taxes

Buying a property can have a positive impact on your taxes. If your expenses (maintenance costs, mortgage interest, indirect repayment, etc.) are higher than the rental value, you can benefit from a tax deduction due to a lower taxable income than you had before.

See our comprehensive and detailed guide: "Buying an apartment or house: how does it work?"/a >

1Swiss Federal Statistical Office (FSO) (2016). Number of vacant housing units. See https://www.bfs.admin.ch/bfs/en/home/statistics/construction-housing/surveys/lwz.html